It’s hard to believe, but the same system for estimating television viewership and determining the value of advertising buys has been in place since the 1950s. Even more fascinating, is that primarily one source, the Nielsen Company, has tracked and delivered that data for all these decades.

As the 2022 upfronts approach, an annual event during which upcoming programming and advertising opportunities are pitched by television media, newer industry players plan on showing how they can do a better job tracking viewers than Nielsen. Does that mean Nielsen ratings will soon be a thing of the past?

The difference between GRPs, CPPs and Impressions

Gross rating points (GRPs) are an estimate of what percentage of a targeted audience is viewing a program during a specific timeframe. Nielsen has collected this data over the years through household participation in surveys and various tracking devices. Although not an exact science, the methodology gave advertisers enough confidence to purchase spots based on cost per point (CPP), the price to reach an intended audience based on a program’s ratings.

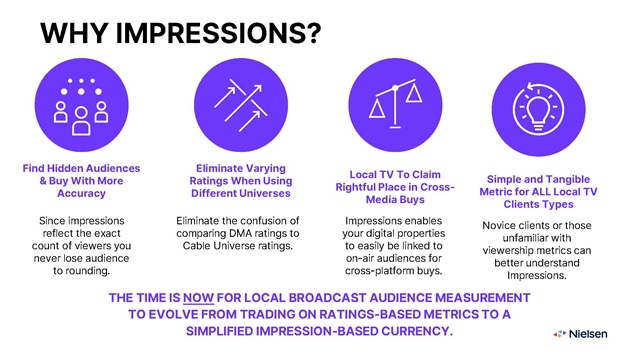

Then television streaming services such as Hulu and AppleTV came along, and tracking done through impressions—how many people actually see that program—become the standard for those newer platforms. With the convergence of linear and streaming TV, the challenge has become this: how do you compare television advertising buys using different measurements?

There is no perfect measurement, but it can be more consistent

First, it’s important to understand that data regarding television viewership can be nebulous. Consumers may not always share accurate information when surveyed and even tracking systems have their limitations. It’s an imperfect science at best. However, wouldn’t it be easier if all measurements were the same? Do we really need to measure linear TV by ratings and streaming by impressions?

According to a recent article in Bloomberg, during the May 2022 upfronts several organizations, including Nielsen, will be discussing their ability to better track TV viewers across platforms. Lisa Baggio, a broadcast media strategist at EXL Media, predicts that this conversation will continue and evolve.

“The search for more definitive TV viewing information is an ongoing journey. It’s also important to note that much of the data available today is at a national level. Even streaming services are unable to provide program specific advertising spots at a local level. The best they can offer right now is impressions within a DMA.”

Baggio says Nielsen also measures viewership based on impressions, so buyers can use impression-based buys on both linear and streaming TV for more accurate comparisons of pricing and performance. And having ratings data in addition to impressions is not a bad thing, since each campaign is unique and any information can help provide additional insights.

Should you shift to impressions when buying TV advertising?

In October 2021 TVSquared surveyed 300 U.S. client and agency buyers, and 70 percent of respondents agreed that all forms of TV should be sold and bought on impressions, with the reasoning being cross-platform measurement.

Impression-based buying levels the playing field by aligning measurement across mediums and allowing media buyers to aggregate all audiences no matter where content is consumed. It removes the silos and streamlines how media is evaluated across platforms, including television, digital, audio, OTT, out-of-home and print. This allows for more strategic planning, targeted messaging, and effective spending.

Baggio and her team are constantly tuned in to the evolution of TV advertising. However, she believes that for now media buying is done best when the needs and expectations of the advertiser are clearly defined, strategies are developed that allow for consistent tracking, and adjustments are made during a campaign when tracking data reveals potential opportunities.

“It will be interesting to see what transpires during this year’s upfront meetings,” she says. We’ll share critical insights with our clients and consider new methodologies if they look promising. Every media buyer dreams of more accurate data and tracking, so we’re eager to see what lies ahead.”

EXL Media has helped clients throughout the United States maximize their spends through strategic planning and buying across all channels. To learn more or for a complimentary consultation with an EXL Media buying specialist, contact Lisa Baggio, Broadcast Media Strategist at lisa@exlmedia.com.